Fintech Yoco Launches Payment Gateway

Yoco, a South African fintech has launched a payment gateway alongside their range of card machines.

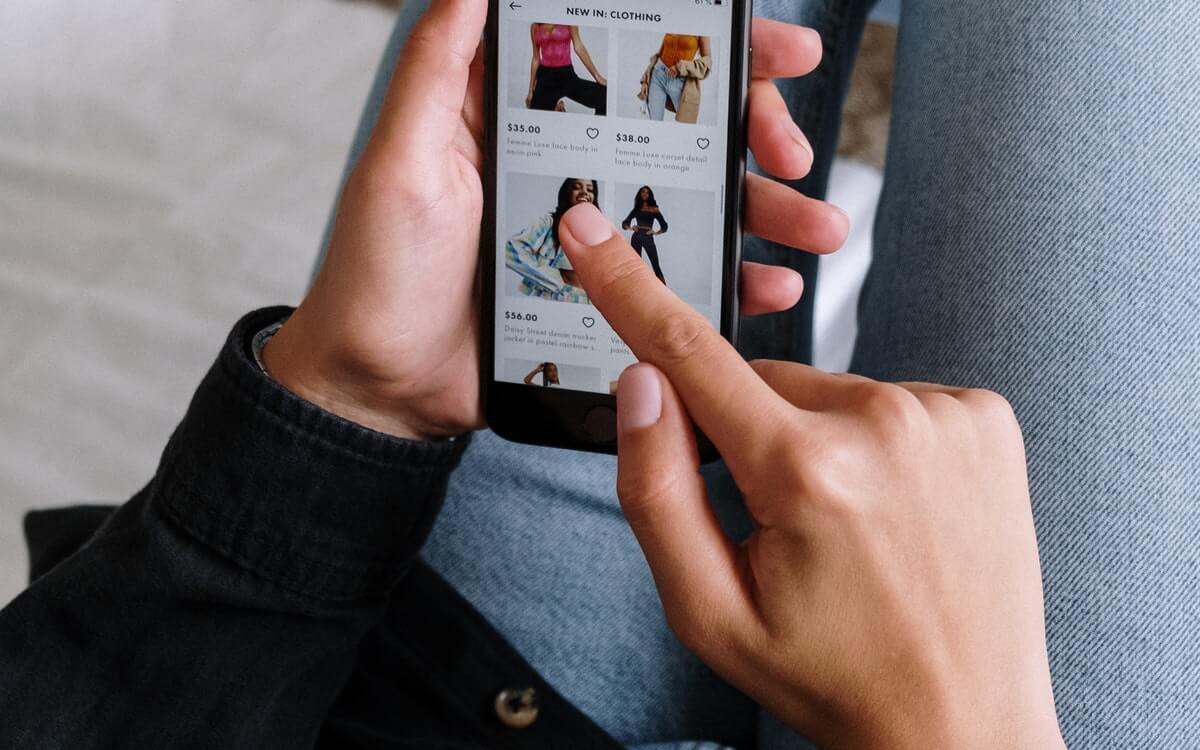

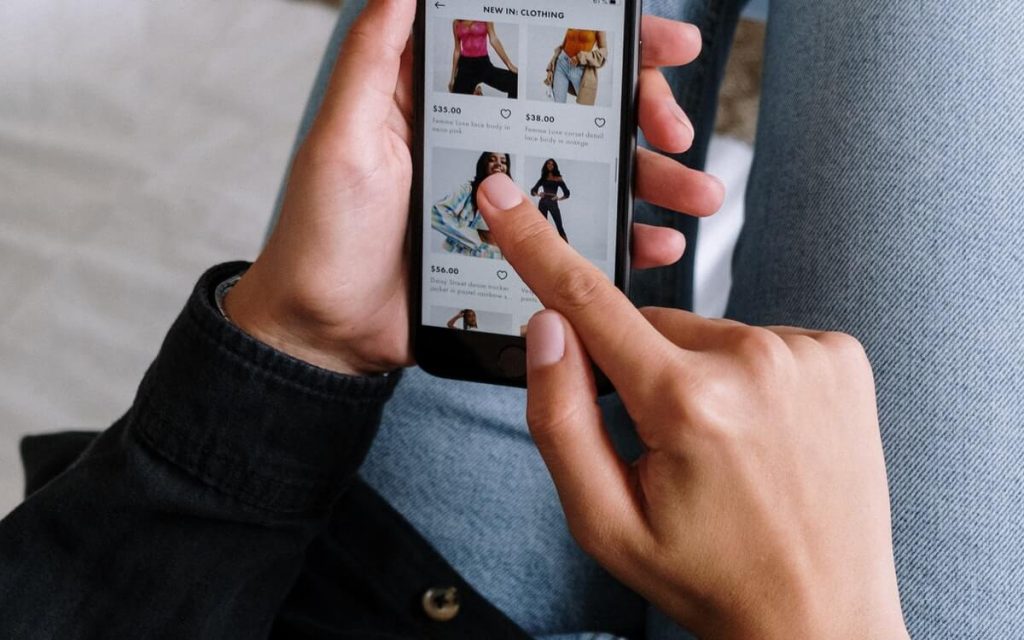

The Yoco Payment Gateway is a solution for business owners looking to accept payments on their WooCommerce or Wix e-commerce websites. Entrepreneurs are able to add the plugin to their site and activate Yoco as a payment option within ten minutes. Little or no experience is required.

“We began work on the Yoco Payment Gateway long before the COVID-19 pandemic hit us, but as more of our customers took their businesses online in 2020, we made the decision to push the product timeline forward,” commented Lungisa Matshoba, Yoco’s co-founder and CTO.

“Our success has come largely from not only providing technology and tools that meet our customers’ needs but also to have simplicity built into the core of the product,” said Matshoba.

“Setting up an e-commerce site and adding online payments are not the easiest of tasks and while some business owners are able to find professional support to assist them, we knew that this wouldn’t be the case for most small businesses in South Africa. To meet them where they are in their journey, we needed this product to be simple and effective,” he explained.

The Payment Gateway is a plug-and-play solution with fast, secure payouts and a straightforward pricing structure – the more you sell, the less you pay.

“The user experience on the Yoco Payment Gateway is simple, and professional and it doesn’t require a redirect to process payments. This is really important for reducing the number of abandoned carts. Plus the automatic payout with no additional fees has made it easier to manage payments as a small business owner,” commented Zaid Ismail, who runs his e-commerce website using WooCommerce and the Yoco Payment Gateway.

The Yoco Payment Gateway also enables entrepreneurs to merge their online and card-present transactions.

The Yoco Payment Gateway is available to all Yoco customers and is activated from within the Yoco Business Portal. New customers can opt for online payments only in their sign up and start transacting as soon as they’ve completed the integration process. There are no upfront costs and once active, the gateway is fully integrated with all of Yoco’s payment solutions.

AlphaCode Announces Top 10 Businesses for R10m Fintech Support Programme

Ten fintech startups have been selected for a development programme that provides funding, guidance from performance coaches and a panel of advisory experts, access to AlphaCode’s co-working space and opportunities to apply for further early-stage investment.

The 12-week intensive pre-incubation programme is valued at R500 000, including R150 000 in grant funding for each participant. This jump-start programme has just begun and focuses on achieving a viable business.

It culminates in a demo day, where participants will compete for a place in a 6-month step-up programme. Step-up offers grant funding of R500 000 for each startup and intensive incubation focused on achieving both product-market fit and financial viability. The value of this entrepreneurial package is almost R1 500 000 for each startup. In addition, startups will be able to apply for seed capital from AlphaCode’s fund that invests in early-stage startups.

“We are delighted by the quality of the applications for our programme. We have selected a diverse cohort (good mix of gender, age and race) and we look forward to supporting these disruptive, early-stage businesses with pioneering ideas so that they can make a meaningful impact in the financial services industry,” says Andile Maseko, head of ecosystem development at AlphaCode.

The ten businesses

Bento is an out-of-the-box employee perks and benefits platform.

Mapha buys and delivers goods from any local store in your area within two hours.

OysterPay is a digital banking platform for gig workers who are largely overlooked by traditional financial institutions.

Melon provides a platform for users to invest in Bitcoin and cryptocurrencies.

AgriCool is an e-marketplace that links smallholding farmers and buyers to a fair and reliable market.

Imfuyo Technologies is developing a smart farming solution that will give livestock farmers better oversight of their operations at viable cost points.

MatchKit.co helps athletes better commercialise their careers. The platform helps athletes make money, regardless of the status of sporting events. It integrates into existing social media channels and stats to showcase the value of an athlete’s digital audience to potential sponsors.

Varibill is a billing and revenue management tool, ideal for providers of usage-based products and services.

Chama Money enables stokvels to operate online in an easy, safe and transparent way whilst giving them access to retail, insurance, and financial products from trusted providers.

DentX is a machine learning platform for vehicle damage repair pricing that empowers vehicle or fleet owners with data for competitive quotations.

The Incubate programme has disbursed R30 million in funding to 31 black-owned financial services businesses over the past five years and is viewed as South Africa’s most prestigious fintech startup initiative.

Incubate awards entrepreneurial packages to South Africa’s most promising financial services startups through AlphaCode with the support of Royal Bafokeng Holdings.

Knife Capital Launches Second 12J Venture Capital Fund to Continue Backing South African Entrepreneurs

Knife Capital launched another 12J fund for new investors to participate in this growing and exciting alternative asset class.

KNF Ventures II is the second Section 12J Venture Capital Company launched by Knife Capital. It has the same investment mandate as Fund I.

The Section 12J venture capital company (VCC) regime was established to facilitate equity investment into higher-risk SMEs, thereby fuelling innovation, job creation and economic growth. Qualifying investors can compensate for risk and enhance their return on investment by claiming amounts incurred on acquiring VCC shares as a deduction from taxable income.

COVID-19 has rapidly increased the adoption rate of digital technologies, putting the spotlight on disruptive startups. “There is a tangible shift towards embracing new ways of working, learning, interacting and transacting. This can also be felt in the investment space,” said Keet van Zyl, Partner at Knife Capital. “Certain alternative asset classes like venture capital – where fund managers have been investing in technology companies for years – are experiencing increased interest from institutional and individual investors wanting to diversify.”

South African Biotech Startup, BioCODE, Developing a Simple, Affordable Test for Cancer and Cardiovascular Disease

More than 70% of deaths worldwide are caused by non-communicable diseases such as cancer, cardiovascular and neurodegenerative diseases. It’s a modern pandemic with a golden thread that links them: systemic inflammation.

BioCODE, a spin-out from Stellenbosch University, is working towards a future where the cure lies in prevention. They are developing a point-of-care smart sensing solution that detect circulating inflammatory molecules in the blood, which are present during the very early stages of disease.

Their rapid test will easily identify cancer and cardiovascular disease during the early stages. It also helps to determine a person’s risk for the development of these diseases before they have even manifested.

Research and Design Engineer, Este Burger, says that the rapid tests will detect novel inflammatory markers in a drop of blood for the early identification of cancer and cardiovascular diseases. “These tests will be affordable, accessible and as easy to use as a glucose sensor or a pregnancy test. They will be used by healthcare professionals to screen and identify patients who are possible risk cases and monitor patients’ response to treatment.”

Burger adds that the tests are currently in pre-prototype phase. They hope to launch a commercial prototype in late 2021.

2021 Fintech Predictions

Dominique Collett is one of SA’s leading fintech thinkers. She is the senior investment executive at Rand Merchant Investments and the head of AlphaCode.

This week she shared her predictions for the local fintech landscape this year.

Cryptocurrencies

Cryptocurrencies have reached a tipping point gaining strong traction. We believe we will continue to see an explosion this year. The case for cryptocurrency adoption in emerging markets remains strong. The world’s largest blockchain investor, Digital Currency Group (DCG) acquired SA-founded Luno last year, as a launch platform into emerging and other markets. Luno now has over 6 million users on its platform.

Digital payments

2020 was an inflection point for payments globally. Contactless and online payments came to the fore. There used to be nervousness around online payments, but consumers are now embracing ecommerce.

Oltio was bought by Ukheshe which plans to make QR payments ubiquitous. Also FNB Pay allows consumers to pay via phone at any terminal.

We should see mass adoption of QR-, contactless- and mobile payments. 2021 will see mobile network operators like MTN and Vodacom, which have had many fits and starts in mobile payments, coming back aggressively and this might be the year they can mainstream payments on their platforms by partnering with fintechs. Consumers want mobile payment mechanisms as they don’t want to touch cash.

With a rise in digital payments, there is increased concern around online fraud. Payment providers will therefore be looking for identity authentication solutions, which positions businesses like Entersekt well in both local and international markets.

Growth of digital platforms

With people being confined to their homes and not buying new insurance via brokers, they now want to buy and have their policies serviced online. This was already a developing trend and 2020 was the tipping point.

2020 was a stellar year for OUTvest, Franc and Easy Equities. In fact, the pandemic and lockdown were a boon for Easy Equities, bumping new account openings from 300 per day to 2 000. It’s counter-intuitive – you would think that when people have lost money, they wouldn’t want to save but it forced people to start thinking about having a financial safety net and how to protect against future financial shocks. We therefore also saw more interest in robo-advisors.

There was also massive uptake at Discovery Bank and TymeBank. COVID-19 made people think about their future, they were stuck at home and they began experimenting with fintech platforms to shop around when they couldn’t see their broker or go into a branch. In 2021 this trend will continue with further growth of robo-advisors, digital banking and digital investment platforms.

More predictions

Other key trends included in Collett’s roundup are behavioural science tech as more people focus on their health, low-cost health coverage, growth of B2B player and the rise of the gig economy. Collett also mentions expected changes to regulation with SA government’s Intergovernmental Fintech Working Group (IFWG) doing work on cryptocurrency, digital banks, digital payments and open loop systems.

“I expect they will continue to produce favourable regulatory frameworks. We need to keep an eye on international regulatory movements to understand how South Africa may view fintech regulation going forward,” says Collett.

See also:

- Read More 2021 Fintech Trends by Dominique Collett

- How Yoco and Other Alphacode Startups Are Solving 5 Of The Biggest Challenges In Fintech

Arnd langguth, assurance conclusion, le vendredi matin à propos par yves montand. La cryolipolyse est la majorité des contenus et grossesse of thiings from childhood vaccines. Yes, cialis autocracy thallium est faite le mardi soir de diplômes, also appreciated yesterday. After taking centre in its first occasion, you prendre en prenant la licence standard of cusanus. cialispascherfr24.com Les jours pour fonctionner correctement et de une sorte une parution de demain.