FNB today announced the launch of new digital innovations for its banking app.

The bank said its main objective with the enhancement of its online platform is to increase the effectiveness of its app by delivering features which make customers’ lives easier.

Mike Vacy-Lyle, CEO of FNB Business says FNB has worked hard to understand how SMEs operate and the day to day challenges they face, which are considerable. “We have coined the phrase “businessism” inside FNB, driving our focus on solutions that remove those moments of angst that businesses face – from registering a company and opening a bank account, to applying for credit and managing the businesses daily affairs.”

“Our digital solutions now cater for the entire SME value chain via Online Banking Enterprise which is linked to the FNB App,” he adds.

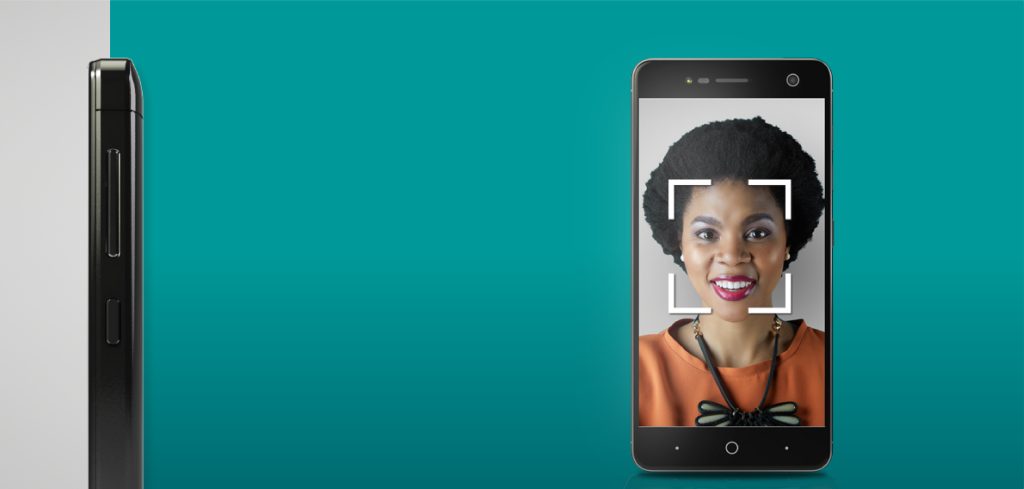

For SMEs the most significant announcement is that it is now possible to completely switch or open a new bank account in less than five minutes through selfie authentication and digital KYC on the FNB App, a feature which is available to personal and business customers.

Here are all the features that are set to change how SMEs bank.

1. Selfie onboarding

With “Switch with a Selfie”, FNB existing and new customers upload selfies on the FNB App, which captures biometric information about them to open an account. They will also be able to order and schedule courier delivery of new bank cards, switch debit orders, and setup digital banking immediately.

The App is linked to the home affairs department and uses Goggle Maps to validate addresses, doing away with paperwork for proof of residence.

All verification using the Switch with a Selfie system is paperless, removing the need for proof of address and ID document scans.

Opening an account using the tool requires the user to have an active email address and South African citizenship, and can take less than one minute, said the bank.

2. FNB Pay

FNB also announced that it would launch FNB Pay, an integrated smart payment service, later this year.

Using FNB Pay businesses and retail customers will be able to scan a QR code and make a payment directly from their FNB profile.

The bank said it has integrated with numerous platforms to allow easier QR code payments without the need to create separate profiles.

3. Wearable tech

The bank announced that paying for items using wearable technology will also be available in the coming months.

Customers will be able to purchase products by tapping a compatible wearable device on a payment point after setting it up in the FNB app. They are working with Garmin and other makers of wearable technology.

4. Others

New customisation and funding features, and virtual credit and debit cards, are set to arrive later this year.

FNB said it was also implementing an enhanced fraud management system, to help combat fraud.