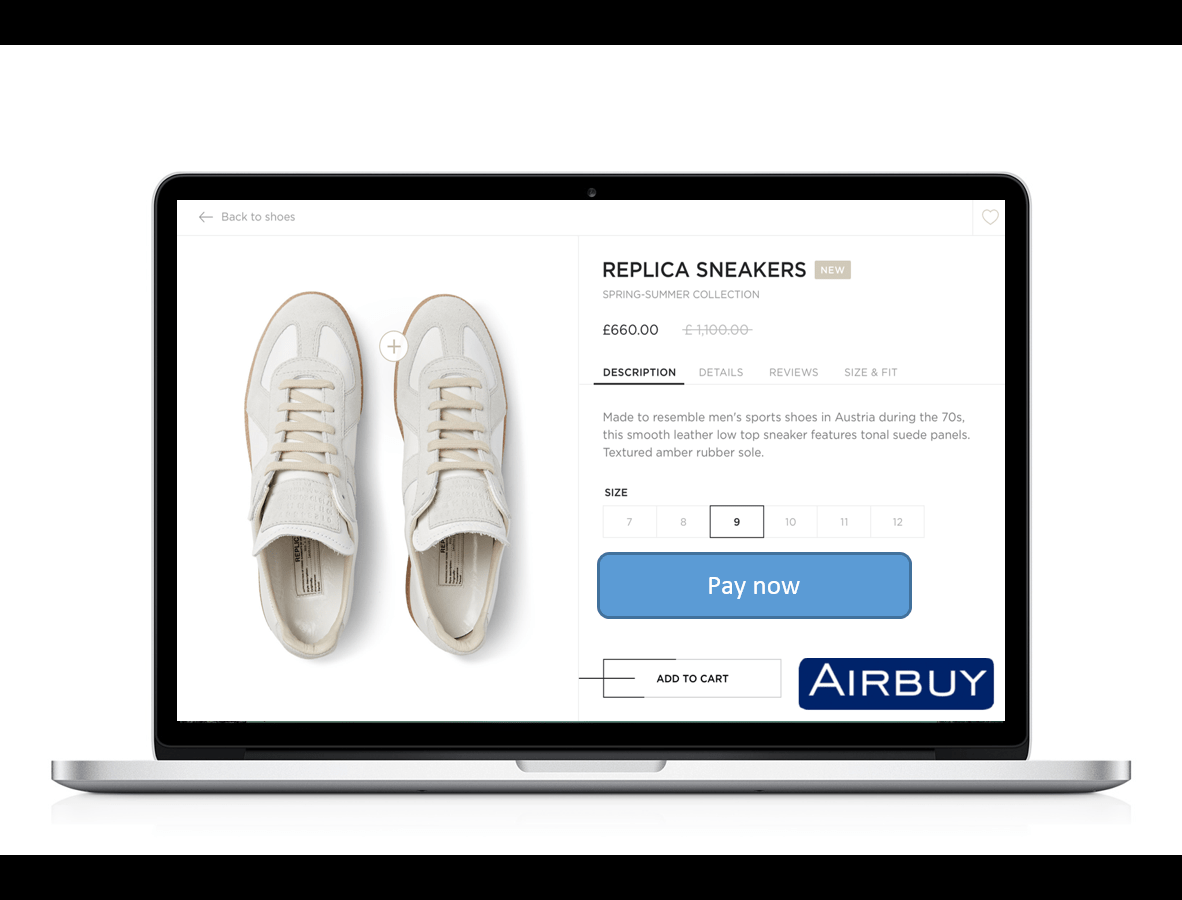

Following its official launch at last year’s entrepreneurship event Demo Africa, Airbuy, an alternative payment option that allows e-commerce sites to accept payments without customers exposing their banking details, has now expanded across the African continent, thanks to the networks and connections its founders established at the event.

The Tshimologong-based startup was founded by Tshepang Kobo (CEO), Kabelo Twala (CTO) and Njabulo Makhathini (head of business development). Twala and Kobo are BSC Wits University graduates while Njabulo graduated from the GIBS Business School.

“We currently have a footprint in South Africa with 56 e-commerce sites that we are busy integrating with our button. We are aiming to increase this number in the next six months by signing up more e-commerce platforms and in-app purchase [portals] for gaming apps in South Africa and other African countries by plugging into startup networks and tech hubs,” says Kobo. To date they also have a presence in Mozambique, Ghana, Nigeria and Morocco.

Amid growing concerns over cybercrime and credit card fraud, Airbuy gives consumers the freedom to trade online without risk.

“It [Airbuy] doesn’t require you to put in your banking details as it uses Airbucks (digital tokens) that allow users to make payments on participating e-commerce sites. Airbucks can be topped up by direct EFT, and in the near future, users will be able to top up using mobile banking, airtime conversion and bitcoin,” says Kobo.

All current payment options available in the market require the customer to have a credit card or a debit card at the least, which has proven to be very risky with the growth of CNP (card not present) related crime, says Kobo. “Airbuy aims to partner with organisations to tackle this problem that is hindering Africa’s e-commerce growth. We aim to partner with banks and mobile networks to offer more to the African continent.”

Many potential purchases drop off when consumers are required to input their financial information, their innovation helps to circumvent this. “Users cannot withdraw the money they’ve put in, they can only spend it online,” says Kobo.

Users can also earn Airbucks through promotions in marketing campaigns. Airbuy users can also share Airbucks with other users by transferring them digitally.